Quant-Grade Crypto SignalsInstant Crypto API Access

Feed AI signals, risk metrics, and sector rotations into your trading system — tested on 6,000+ tokens.

Get Free Crypto API Access

View API RESOURCES

Key Benefits

- Removes guesswork from quant model design

- Institutional-grade signals, sentiment, and risk metrics

- Historical archives for backtest compatibility

- Built for systematic and hybrid strategies

Trusted by

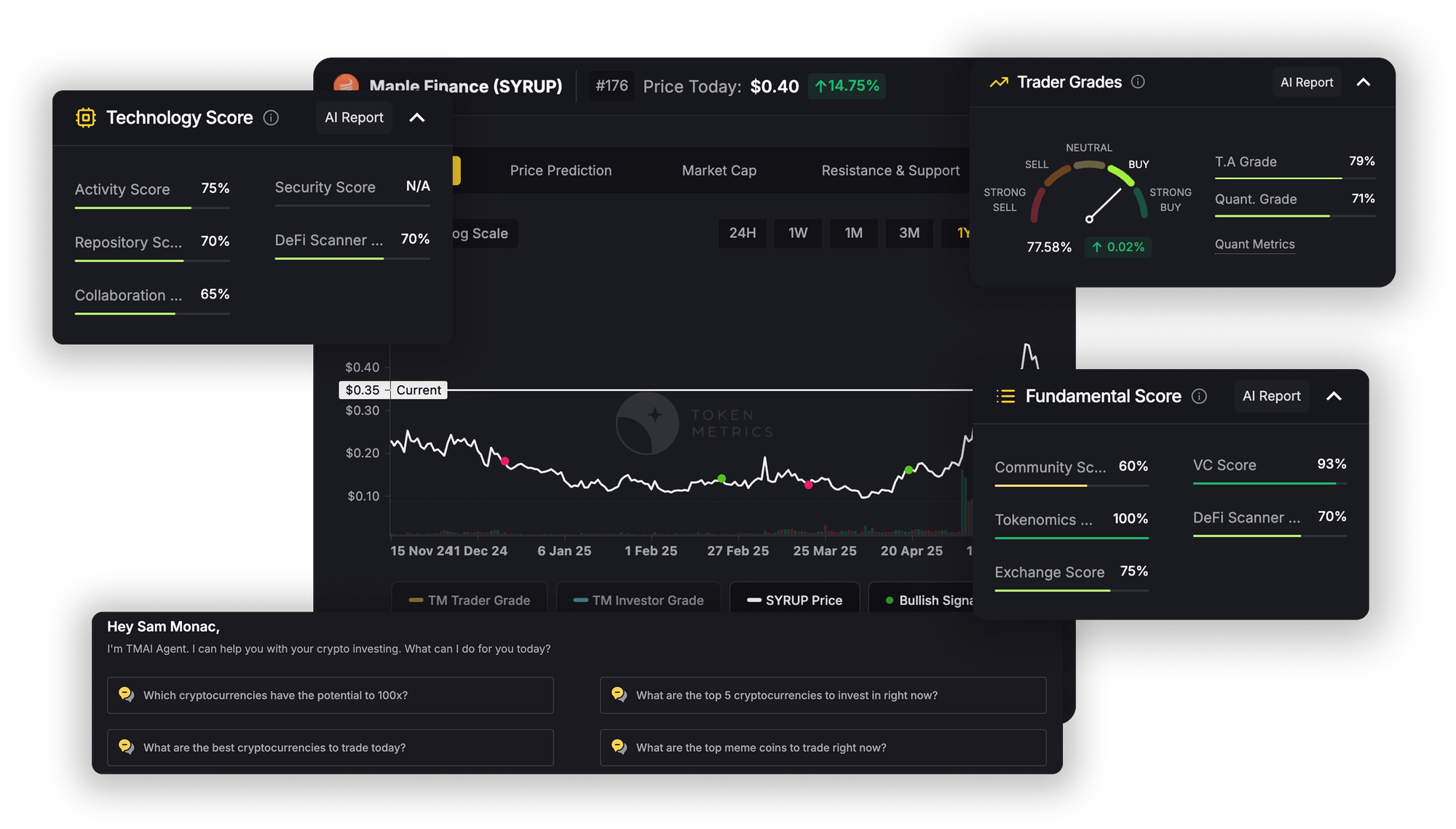

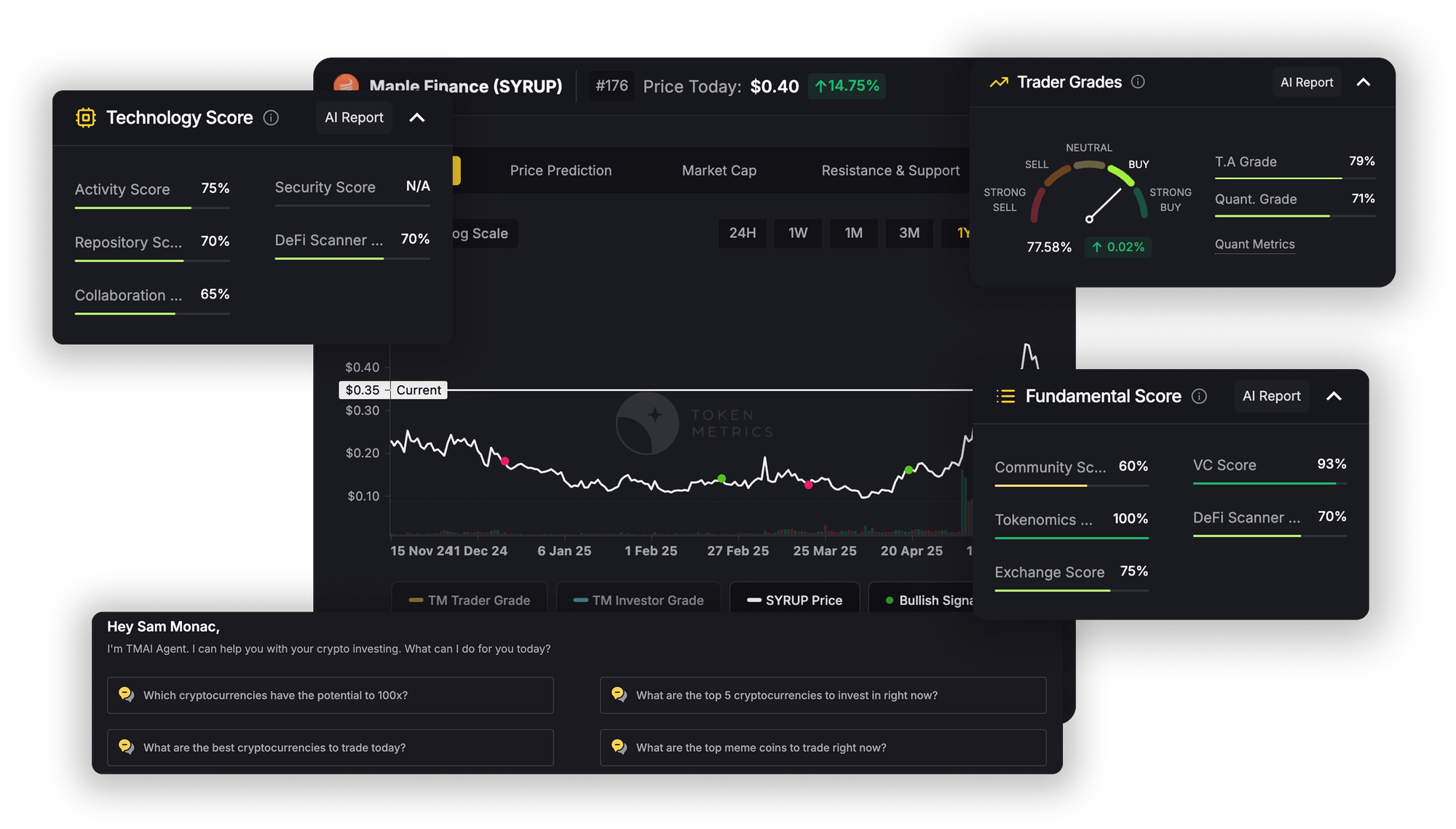

Feature Deep Dive

Grades API

- Streams AI-based 0–100 scores for trader and investor behavior.

Grade Deltas Engine

- Highlights real-time strength shifts for trend breakouts.

Bull/Bear Signal Feed

- Binary signal flips ideal for systematic triggers.

Bull/Bear Signal Feed

- Binary signal flips ideal for systematic triggers.

Historical Grade API

- Export full score history for model testing and validation.

Why Solo Devs Choose

the Token Metrics Crypto API

Institutional-Grade Trader & Investor Grades

AI-powered 0–100 scores reflect real-time strength and market sentiment.

Real-Time Trend Flips & Deltas

Bull/bear shifts, momentum reversals, and breakout filters built-in.

Quant-Ready API for Alpha Generation

Built for signal design, capital allocation, and regime tracking.

Backtesting Support with Historical Data

Hourly signals, 3+ years of candles, and CSV/API export support.

Typical Retail Workflow

Ingest: Stream /trader-grades into Snowflake or Databricks

Enhance: Join signals with BTC futures for strategy overlays

Validate: Backtest using /quantmetrics and historical deltas

Deploy: Pipe alpha signals to trading system via WebSocket

Monitor: Adjust macro exposure using narrative indices and sentiment flips

What You Can Build

- Real-time long/short quant strategies

- Grade-delta breakout trading models

- Sentiment-based volatility or rotation filters

Benefits of Using

Token Metrics Crypto API

- Removes guesswork from quant model design

- Built for rapid prototyping

- Simple REST format with no SDK dependency

- Access to advanced metrics usually reserved for funds

Benefits of Using

Token Metrics Crypto API

Trading Funds

Success Stories

Let Me Know

Multi-agent portfolio manager built in one weekend

0XTMAI Twitter Bot

Auto-tweets grades & support/resistance every hour

LHedgerAI

Single-founder Efficient-Frontier optimiser using Token Metrics Grades

View Demo

Core Endpoints

/trader-grades Hourly AI trend scores + bull/bear classification

/sentiment Aggregated social and on-chain sentiment metrics

/indices-performance Real-time sector index performance tracking

/quantmetrics Portfolio analytics: Sharpe, Sortino, drawdown

/signals Binary flips for automated trading logic

Power Your Crypto Intelligence

with Token Metrics API

Access real-time market data, AI-driven insights, trading signals, and more

Switch to annually — get 2 months free!

🚨 Pay less — up to 35% off with staked TMAI – Stake Now!

Basic

Free

/month

API Calls/Month

5,000

Rate Limit

20 Rq/m

Endpoint

Indices, Indicators

Web Socket

1

History

30 D

Get started

Advanced

Popular 🔥

$99.99

/month

API Calls/Month

20,000

Rate Limit

60 Rq/m

Endpoint

Indices, Indicators

Web Socket

3

History

3 M

Get started

Premium

$199.99

/month

API Calls/Month

100,000

Rate Limit

180 Rq/m

Endpoint

Reports, AI Agent

Web Socket

6

History

3 Y

Get started

VIP

Elite Access 💎

$799.99

/month

API Calls/Month

500,000

Rate Limit

600 Rq/m

Endpoint

All Endpoints

Web Socket

12

History

Unlimited

Get started

Switch to annually — get 2 months free!

🚨 Pay less — up to 35% off with staked TMAI – Stake Now!

Basic

Free

/month

API Calls/Month

5,000

Rate Limit

20 Rq/m

Endpoint

Indices, Indicators

Web Socket

1

History

30 D

Get started

Advanced

Popular 🔥

$99.99

/month

API Calls/Month

20,000

Rate Limit

60 Rq/m

Endpoint

Indices, Indicators

Web Socket

3

History

3 M

Get started

Premium

$199.99

/month

API Calls/Month

100,000

Rate Limit

180 Rq/m

Endpoint

Reports, AI Agent

Web Socket

6

History

3 Y

Get started

VIP

Elite Access 💎

$799.99

/month

API Calls/Month

500,000

Rate Limit

600 Rq/m

Endpoint

All Endpoints

Web Socket

12

History

Unlimited

Get started

Our Customers Can’t Get Enough

“The historical data and real-time grade deltas from Token Metrics allowed us to backtest and deploy a new alpha strategy in weeks, not months. It’s a clean, reliable feed that integrates directly into our quant stack.”

Alexei Volkov, Head of Quant Strategy, Cygnus Capital

The Only Crypto API Built for Quants

Quant and trading funds thrive on good crypto data—and Token Metrics Crypto API delivers it. Designed specifically for alpha generation, macro rotation, and portfolio optimization, this crypto API suite includes real-time crypto Trader and Investor Grades, crypto signal flips, and crypto sector indices backed by explainable AI. Whether you’re designing delta-neutral overlays, sentiment filters, or long/short strategies, the crypto API feeds fit seamlessly into your quant stack. With CSV exports, warehouse ingestion, and WebSocket support, you get institutional-grade infrastructure out of the box. Scale faster, hedge smarter, and rotate earlier—with the only crypto API built for quant performance.

Frequently

Asked Questions

Is this built for systematic strategies?

Yes—feeds are designed for algorithmic ingestion and automation.

Do you provide historical data?

Yes. Hourly and daily grade history and full candle archives are available.

Can we use this in a backtest engine?

Absolutely. You can export via CSV or ingest into your quant framework..

What chains or tokens are covered?

We cover 6,000+ tokens across major chains and sectors.

Do you offer SLAs or custom support?

Yes. Enterprise plans include SLAs, custom endpoints, and engineering support.