Manage Treasury Risk

Using Real-Time On-Chain Metrics

Protect DAO treasuries and optimize yield with AI-powered alerts, sentiment, and risk grades that signal exits, rotations, and hedges.

Get Free Crypto API Access

View API RESOURCES

Key Benefits

-

Detect weakening tokens early via AI signals -

Rotate funds intelligently using sentiment data -

Automate hedges before large drawdowns -

Avoid narrative crashes with proactive exits

Trusted by

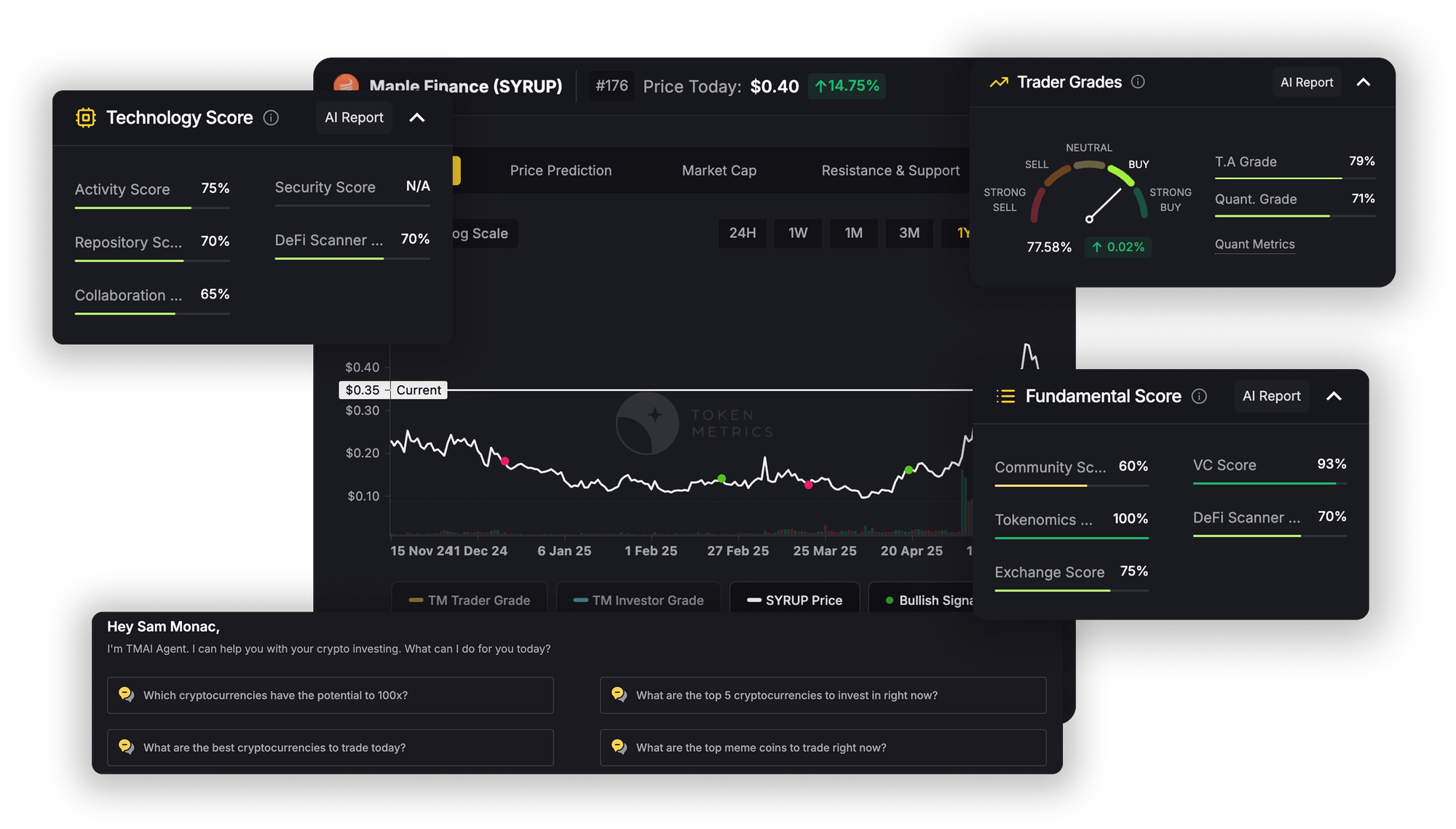

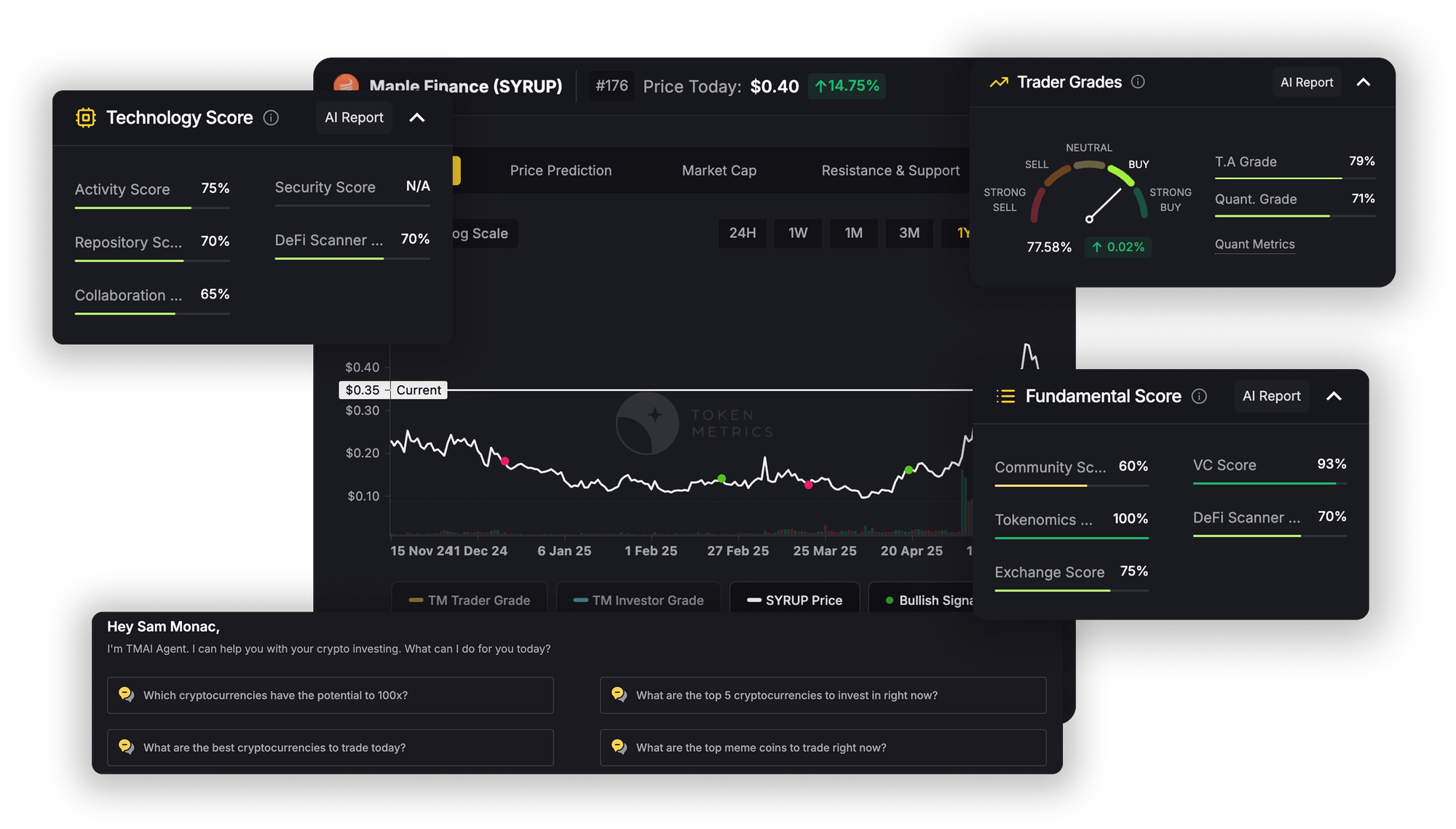

Feature Deep Dive

Investor Grades API

- Scores long-term token strength for stable treasury asset allocation.

Sector Indices API

- AI-curated baskets provide instant diversification across crypto narratives.

Scenario Analysis API

- Simulates BTC dominance shocks and liquidity stress events on your portfolio.

Sentiment Feed

- A macro mood index helps time farm exits and rotations into stablecoins.

Quant Metrics API

- Live Sharpe, Sortino, and drawdown stats to guide rebalancing decisions.

Why Treasury Managers Choosee

the Token Metrics API

Data-Backed Allocation

Investor Grades and indices help identify outperformers versus high-risk assets.

Proactive Risk Management

Scenario analysis and risk flags help you rotate capital *before* drawdowns occur.

One-Stop Integration

Plug into any stack with a simple REST API, webhooks, and dedicated SDKs.

Automated Monitoring

Set up alerts to track fundamental shifts in your treasury holdings 24/7.

Typical Retail Workflow

Pull wallet balances from on-chain or custodian sources

Fetch Investor Grades and Risk Metrics for each token

Optimize portfolio using rules-based logic or our Quant Metrics

Execute rebalancing trades using a DEX/CEX integration

Monitor /sentiment and rotate to stables on bearish market signals

What You Can Build

-

DAO Treasury Dashboards -

Real-Time Token Risk Monitors -

Rotation Bots Using Sector Grades

Benefits of Using

Token Metrics Crypto API

-

Unified data across price, AI signals, and sentiment

-

Built for rapid prototyping

-

Simple REST format with no SDK dependency

-

Access to advanced metrics usually reserved for funds

Benefits of Using

Token Metrics Crypto API

Treasury Management

Success Stories

Let Me Know

Multi-agent portfolio manager built in one weekend

0XTMAI Twitter Bot

Auto-tweets grades & support/resistance every hour

LHedgerAI

Single-founder Efficient-Frontier optimiser using Token Metrics Grades

Core Endpoints

/investor-grades Long-horizon token scores

/signals Trend flips and breakout events

/risk Audit, holder, and inflation risk data

/sentiment Real-time macro and token sentiment

/indices Sector rotation and narrative tracking

Power Your Crypto Intelligence

with Token Metrics API

Access real-time market data, AI-driven insights, trading signals, and more

Switch to annually — get 2 months free!

🚨 Pay less — up to 35% off with staked TMAI – Stake Now!

Basic

Free

/month

API Calls/Month5,000

Rate Limit

20 Rq/m

Endpoint

Indices, Indicators

Web Socket

1

History

30 D

Get started

Advanced

Popular 🔥

$99.99

/month

API Calls/Month20,000

Rate Limit

60 Rq/m

Endpoint

Indices, Indicators

Web Socket

3

History

3 M

Get started

Premium

$199.99

/month

API Calls/Month100,000

Rate Limit

180 Rq/m

Endpoint

Reports, AI Agent

Web Socket

6

History

3 Y

Get started

VIP

Elite Access 💎

$799.99

/month

API Calls/Month500,000

Rate Limit

600 Rq/m

Endpoint

All Endpoints

Web Socket

12

History

Unlimited

Get started

Switch to annually — get 2 months free!

🚨 Pay less — up to 35% off with staked TMAI – Stake Now!

Basic

Free

/month

API Calls/Month5,000

Rate Limit

20 Rq/m

Endpoint

Indices, Indicators

Web Socket

1

History

30 D

Get started

Advanced

Popular 🔥

$99.99

/month

API Calls/Month20,000

Rate Limit

60 Rq/m

Endpoint

Indices, Indicators

Web Socket

3

History

3 M

Get started

Premium

$199.99

/month

API Calls/Month100,000

Rate Limit

180 Rq/m

Endpoint

Reports, AI Agent

Web Socket

6

History

3 Y

Get started

VIP

Elite Access 💎

$799.99

/month

API Calls/Month500,000

Rate Limit

600 Rq/m

Endpoint

All Endpoints

Web Socket

12

History

Unlimited

Get started

Our Customers Can’t Have Enough

“Using the Investor Grades and Risk API, we’ve automated our treasury monitoring. It’s like having a 24/7 analyst team flagging risks before they become problems.”

Anya Sharma, Treasury Lead, Meridian DAO

Protect DAO Treasuries with Predictive AI Signals

Treasury and yield managers in crypto face asymmetric risk. Token Metrics Crypto API provides real-time crypto insights that protect capital: AI grades, trend shifts, sentiment breakdowns, and sector rotations. Whether you’re managing DAO funds or protocol reserves, this is your new alpha stack. With easy integration via REST and SDKs, treasury teams can monitor dozens of tokens, optimize yield strategies, and avoid drawdowns — all powered by predictive crypto AI analytics.

Frequently

Asked Questions

Can I monitor multiple tokens in real time?

Yes. You can query dozens or hundreds of tokens simultaneously using our API endpoints.

What happens when a token flips bearish?

The API delivers a clear signal, allowing you to programmatically exit a position or hedge your exposure.

Do you support DeFi yield tokens?

Yes. Token Metrics covers thousands of tokens, including LP and reward tokens across all major chains.

Can I integrate this into our multisig dashboard?

Absolutely. All endpoints are compatible with Web3 backends and can feed data into Gnosis Safe or other treasury UIs.

How often is the risk data refreshed?

Investor Grades and signals update hourly, while structural risk metrics like audit status refresh daily.