New Live: TM100 Regime Signals

The Self-Driving

Crypto Index.

Capture the upside of the Top 100 assets. Protect your capital when the market crashes. We use regime adjustments to rebalance your portfolio weekly and automatically rotate you into stablecoins during downturns.

Stop Trading. Start Investing.

Manual investing is broken. Here is how TM100 fixes it.

The Hard Way (DIY)

📈

Emotional Trading

Buying the top and panic-selling the bottom due to fear.

📉

Zero Risk Controls

You ride the market down -80% in a bear cycle with no exit plan.

🔓

Custodial Risk

Trusting exchanges that might go bankrupt (FTX, Voyager).

Time Spent

Slippage

Missed Rebalances

The TM100 Way

📊

Data-Driven Execution

Automated rebalancing based on technical indicators, not social media hype.

🛡️

Safety Mode

We detect crashes early and auto-rotate to Stablecoins/Gold.

🔐

Non-Custodial

You hold the token. You control the keys. Verifiable on-chain.

Time Spent

Slippage

Missed Rebalances

Why TM100 Indices?

Smarter. Safer. Automated.

Blend passive and active crypto investing. Using regime adjustments based on technical indicators, they dynamically rebalance across sectors, targeting hot tokens and shifting to stablecoins in downturns.

Passive Investing

Hands-free, convenient investing through proprietary trading signals and automated rebalancing for optimal performance.

Convenience

Integrated Token Metrics Wallet enables seamless buying, managing, and selling of indices.

Regime-Driven Rebalancing

Automatically rebalance Index portfolios based on technical indicators to stay up-to-date with current market trends.

TM100 Benefits

Experience the future of automated crypto investing.

Safety Mode

Automatically shifts to Stores of Value (Yield Bearing Stablecoins) when risk rises. Captures Top-100 growth in bull markets, protects capital in bear markets.

Rules, Not Emotions

Transparent, objective rules you can audit on-chain. Selection criteria: Top 100 Tokens, TVL > $300K, Circulating Supply > 25%.

Safety Mode

Automatically shifts to Stores of Value (Yield Bearing Stablecoins) when risk rises. Captures Top-100 growth in bull markets, protects capital in bear markets.

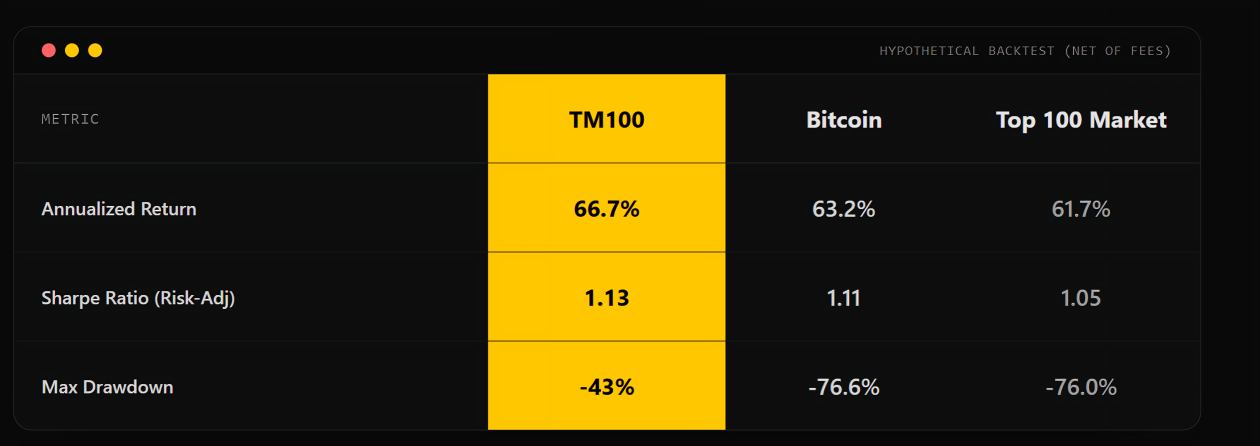

Better Returns. Lower Volatility.

Don’t just buy the market. Beat it.

“TM100 captured 1.4x the return of Bitcoin with half the drawdown depth.”

*Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. Past performance is not indicative of future results.

What You Get

Broad diversification across the Top-100 during risk-on periods

Built-in drawdown mitigation via stablecoin rotation in risk-off

This is your token you can leverage in DeFi.

Security, Audits & Risk Controls

Wallet Management

Secure, verified user access and identity management.

Audit

Independent audits ensuring on-chain integrity and safety.

Key Management

Policy-based key custody and secure transaction signing.

FAQs (Rapid-Fire)

What do I hold?

Non-custodial smart-contract position; proportional ownership.

Fiat or stablecoins?

Yes; buy direct on our platform.

How do regime adjustments work?

Rules-based technical indicators drive portfolio rebalancing; no guarantees.

Reporting/tax?

Exports provided; consult your advisor.

Stablecoins/gold?

Subject to integration, availability, and risk review.

Ready to start?

Be the first to access the future of regime-adjusted crypto investing. Join the waitlist today.

JOIN WAITLIST