Token Metrics is proud to launch the "TM Investor Grade" to help investors identify promising long-term investments in the world of cryptocurrency. The grade is comprised of three subsets:

- The Fundamental Grade

- The Technology Grade, and

- The Valuation Grade.

Our statistical analysis and machine learning techniques help calculate these grades. They account for many data points to provide a strong indication of the relative strength of each crypto asset or a project.

The TM Investor Grade is intended for use by investors looking to hold onto investments for a longer period of time, created by combining the Fundamental Grade with the Technology Grade and Valuation Grade.

Fundamental Grade

Fundamental analysis has always been a crucial part of the research process at Token Metrics. Before considering any potential long-term investments, we conduct a thorough fundamental analysis to understand an asset's underlying strengths and weaknesses. Our use of fundamental analysis is how we discovered the promising investment opportunity in Helium back in 2018.

However, manually performing fundamental analysis on every token in the market is not feasible. This is why our research and data science teams automated the process. The result is our Automated Long-term Investor Grade. This grade considers a wide range of data points and applies statistical analysis to provide scores in various categories, including valuation, investors, tokenomics, community, and more.

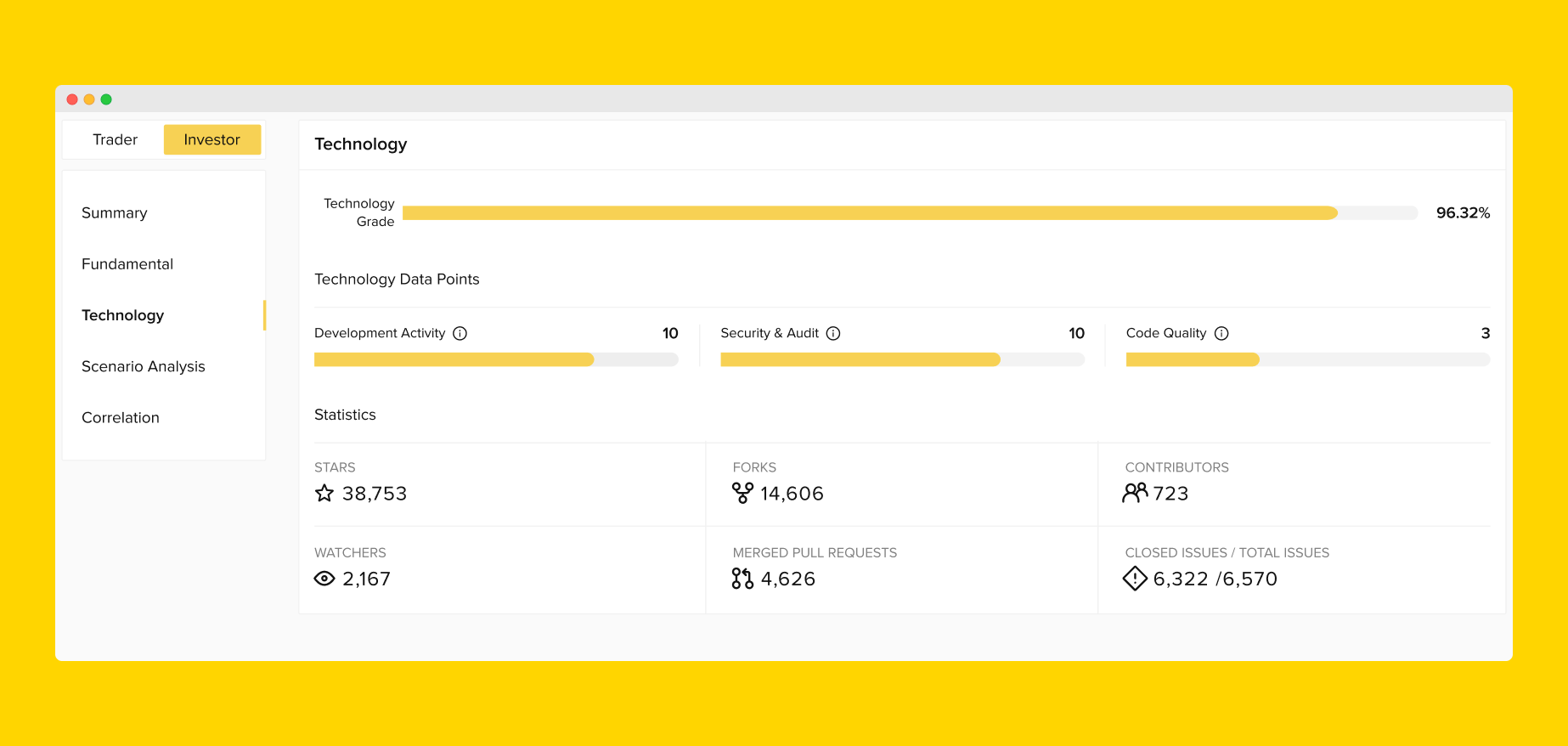

Technology Grade

Token Metrics is also known for conducting code reviews on cryptocurrency projects. This is how we discovered that MATIC was a particularly strong project. Similar to fundamental analysis, our blockchain engineers carried out these reviews manually. However, we have now automated the entire process. Using open source data, we are able to provide technology scores for nearly all crypto assets. This is extremely valuable for investors, as it allows them to assess the long-term security and feasibility of different investments. Our technology scoring is based on three main categories: development activity, security and audit, and code quality.

The development activity category takes into account the contributions of the development community and tracks various community metrics. The security and audit category looks at the security of a project and tries to determine its resilience to hacks and other vulnerabilities. The code quality category measures how well the project's code is written, by evaluating the number of bugs and violations it has and how well it adheres to best coding practices and standards.

We are thrilled that our data science team, in collaboration with our engineering team, has been able to use statistical analysis to scale up our powerful technology scoring to cover almost all assets in the market.

Valuation Grade

The valuation grade compares a project's fully diluted value, or FDV, with the average FDV of different sectors that project belongs to.

Consider this example:

- CRV belongs to sector A and B

- CRV's FDV = 10

- Average FDV in sector A = 20

- Average FDV in sector B = 50

This will show a high valuation grade because the project is undervalued compared to its sectors.

By combining these grades, we get the TM Investor Grade which is much more powerful in determining the strength of the project in the long run.

How To Access

To view the Investor Grade, you can go to the individual token details page. Click on the 'Investor' tab on the left of the screen, and then click on the 'Fundamentals' tab. Then, you will be able to see how the asset is performing in each of the 9 categories we use . All these categories are combined to create the overall Fundamental grade. To generate this grade, we use a wide variety of data sources to gather all the necessary information.

In the same tab, you will find the 'Technology' grade. This grade comprises many different data points. These data points combine into three major categories:

- Development Activity

- Security and Audit, and

- Code Quality.

You can also access the newly-launched feature on the Rating page by pressing the Investor switch next to Trader. This will help you sort all crypto assets by our Long-term Investor Grade.

If you look at the Ratings page - sorted by Investor Grade in descending order [highest to lowest] - these are assets that Token Metrics believes have strong potential in the future.

The TM Investor Grade is a powerful tool for evaluating the long-term potential of cryptocurrency projects. By considering various data points, including fundamental analysis, technology scoring, and valuation grades, the grade provides a comprehensive assessment of a project's strengths and weaknesses.

The grade updates regularly to reflect changing market conditions, making it an essential tool for anyone looking to invest in the cryptocurrency space.

FAQs

1. How does the Investor Grade differ from the Trader Grade?

The Investor Grade is intended for long-term investing, while the Trader Grade is geared toward short-term trading. The data points used to calculate the Investor Grade differ from those used for the Trader Grade.

2. Which grade should I pay more attention to - the Investor Grade or Trader Grade?

If you are interested in short-term trades based on price action, such as swing or day trades, you should consider the Trader Grade. On the other hand, the Investor Grade is more suitable for customers who want to invest long-term and hold on to their assets for the potential of significant returns or to discover undervalued assets.

.png)

.png)

.png)

.svg)

.png)